Well, if John Lennon had still been around today he would undoubtedly have entitled his song Norwegian oil, but whatever way you want to put it Norway is back in the news, and this time not because of adolescents who find themselves with no alternative to sleeping overnight in the bath-tub, but rather because its central bank has been put in a position where it has little alternative but to raise interest rates, even if in fact it would be more comfortable for it not to do so. So, not being in the habit of looking for a quiet life, decision makers over at the Norges Bank decided last week to put themselves in the hot seat by lifting the banks main rate by 25 basis points to 1.5 per cent and in this inauspicious and modest way entered the history books as the first European central bank to raise interest rates since the financial crisis started to ease.

As I say, in doing so the bank put itself straight into the cockpit, since by raising interest rates it became a leading target of interest for that curious but ever growing band of enthusiasts who practice what has come to be known as the “carry trade” whereby investors borrow in countries with low interest rates to invest in higher-yielding assets.

And at this point, with risk sentiment surging there can be little doubt that carry practitioners are simply chafing at the bit to get started. An early warning of what was coming was seen when New Zealand’s dollar climbed to its strongest level in 15 months following a recent report on Radio New Zealand that Reserve Bank Governor Alan Bollard had said that a strengthening currency wouldn’t deter him from increasing borrowing costs. As Sonja Marten, currency strategist at DZ Bank Frankfurt put it: “Bollard’s comments have led to more intense speculation about when the RBNZ will start hiking rates, and have opened the way for more currency gains”. And it didn’t take long for this “intense speculation” to show up in the forex data as the US dollar slid by as much as 1.8 percent against the New Zealand’s one in the wake of the wave of publicity which surrounded the report.

In fact, both the Australian and New Zealand dollars have gained (4 percent and 2.8 percent, respectively) versus their U.S. counterpart since the 6th of October when the Reserve Bank of Australia lifted its cash target by a quarter-percentage point to 3.25 percent, becoming the first central bank among the Group of 20 nations to raise interest rates since the financial crisis began. Indeed Australia raised its benchmark interest rate for a second time only this week - by a further quarter percentage point to 3.5% - thus becoming the only nation to increase borrowing costs twice this year. However Australia’s dollar and bond yields then fell, as traders pared back their bets on a further increase in December when Reserve Bank Governor Glenn Stevens cautioned that higher rates would only come “gradually.”

Signs of Renewed Growth

Norges bank justified its decision by citing “signs of renewed growth” in the global economy, and signalled more increases lay ahead thus giving an indication of the nervousness which now abounds among central bankers about identifying exit strategies from the exceptional monetary measures which remain in place, even as some parts of the world economy start to rebound. Having been accused of being responsible for allowing the recent asset price to develop, they certainly are not eager to go straight off into a repeat performance.

The decision, which had been widely expected, means three of the world’s leading central banks have now embarked on monetary tightening, following rate increases in Israel in August and Australia earlier in October.

According to the statement from Svein Gjedrem, the Norges Bank governor: “The global economy is in a deep downturn but there are signs of renewed growth. Activity in the Norwegian economy has picked up more rapidly than expected.” Just for good measure, and to try to deter hordes of would be krone investors from jumping on board, the Norges Bank quickly stressed that its main rate will likely now remain between 1.25 and 2.25 per cent until next March and will probably only be “raised gradually” thereafter. Governor Svein Gjedrem is on record as saying that a “natural” key interest rate level is around 5 percent, but the last time the benchmark was at that level was in October 2008.

Norwegian fiscal and monetary policy decisionmakers are evidently now busying themselves looking for exit strategies, since Norway’s finance minister Sigbjorn Johnsen joined the exit strategy debate recently by underlining that the government needs to reduce spending as the economy recovers following having more than the normal recourse to the country’s €306bn oil fund over the year in order to to offer support to the domestic economy in the wake of the shock it received from the global crisis. According to Johnsen: “Monetary and fiscal policy must work together to contribute to a stable development in the Norwegian economy.”

What the authorities seem to have in front of them is a difficult trade-off choice between the need for higher rates to curb the acceleration in home prices and the growing strength of private consumption in the context of a tight labour market versus the effect of a rising krone exchange rate on the manufacturing sector.

Central Bank governor Gjedrem also expressed the opinion in September that asset prices “have risen sharply and probably excessively,” in a context where policy rates are “extremely low.” However the stress and tension he is under is pretty evident, since only a few days earlier he had been saying that the strengthening of the krone “suggests that the key policy rate should be kept low for a period ahead.” He is caught in the proverbial monetary policy bind between the rock and the hard place bviously, with just this type of change of nuance from one speech to the next being the stuff on which investors thrive.

In fact the krone has gained 7.8 percent against the euro since the end of June, making it the second-best performer out a list of 16 major currencies and any further strengthening would evidently hurt exporters including Norsk Hydro, Europe’s third-largest aluminum producer, and Norske Skogindustrier, the world’s second-biggest newsprint maker.

Oil Cushion

The Norwegian government has used quite successfully used the cushion provided by its accumulated oil wealth to shield the country from the worst of the global downturn but the Norwegian economy is now rebounding more strongly than the rest of Europe after its first recession in two decades, and new policy measures are now needed. The sudden (and not oil-driven, although in part oil financed) improvement in the Norwegian economy has revived long-standing concerns about the risks of inflation and currency appreciation that have bedogged other oil and gas-rich nations, a danger that Governor Gjedrem has strongly reiterated.

Norway's government have presented a 'slightly expansive' 2010 draft budget that aims to spend more of oil wealth next year compared to 2009 to help the economy maintain momentum as it emerges from what has been a quite mild recession. The budget is based on an anticipated structural deficit (a measure of how expansionary the budget is) which will increase by 0.5 percentage points in 2010. The government said the budget should be seen as 'slightly expansionary' for the economy, and justified the continuing deficit by citing weaknesses in the labour market, weaknesses which are, frankly, not that easy for the outsider to identify, and hence given the issues involved with raising interest rates, perhaps tighter fiscal policy would be a preferable alternative, but still, who would dare to tell those who are running a country which is doing as well as Norway is to do otherwise.

In fact Norwegian policy is based on what is effectively a large annual fiscal surplus, since in order to avoid excessive overheating, Norway invests all of its oil and gas revenues in an offshore fund. In normal years, it spends only 4 percent of the value of the fund, but this year it has dug deeper to try to avoid the worst of the global downturn.

The budget put forward by the governing coalition estimated the 2010 structural non-oil deficit at 148.5 billion Norwegian crowns ($26.35 billion), an increase of 14.6 billion from 2009. This means spending 44.6 billion crowns extra from the oil fund compared to a 'neutral year' for the economy, when it would spend about 4 percent of the oil revenues. Norway's government - like many commodity producers - runs large surpluses including petroleum revenues, surpluses which turn into deficits when the oil and gas money is excluded. Thus, if we take the cash deposited in the Fund into consideration, the budget of what is the world's number six oil exporter is projected to produce a 2010 surplus of 172 billion Norwegian crowns. Make of that what you will.

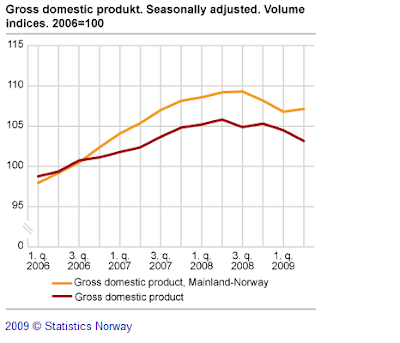

Norway has, as I have been saying, suffered a comparatively mild recession, and mainland Norway resumed growth in the second quarter, even if, once you take the oil and gas component into account, total economic activity is still contracting (see chart).

Mainland Norway GDP was up by 0.3 per cent in the second quarter after falling in the previous two quarters, according to seasonally-adjusted figures. According to the statistics office increased household and government consumption expenditure contributed significantly to the growth, while gross fixed capital formation oil and gas extraction had a particularly negative impact on the GDP.

Increased activity in service industries, particularly in business services, wholesale and retail trade, post and telecommunications – as well as in general government – were the principal contributers to the growth in Mainland Norway GDP.

For the fourth quarter in a row, value added in manufacturing fell, and in the second quarter output was down 1.4 per cent, even if, when compared with the two previous quarters, the decrease was less pronounced. Thus the future value of the krone is not a trivial item here, if it leads to a long term secular decline in manufacturing.

Adding in the extraction industries, total GDP was down by 1.3 percent in the second quarter largely as a result of reduced value added in extraction of oil and gas. This is basically an academic item however, since the oil fund exists precisely to protect the economy from such shocks. Household consumption expenditure, on the other hand, was up by 0.6 per cent. Increased consumption of cars accounted for nearly 60 percent of the rise in household consumption of goods. The growth in household consumption of services was up by 0.4 percent. Final consumption expenditure of general government was also up sharply - by 2.0 percent.

Manufacturing Slump

Industrial production fell by 1.1 per cent in the June to August period as compared with the March to May one (seasonally adjusted figures). The decline was, however, below that registered in the two previous three-month periods.

Output in refined petroleum, chemicals and pharmaceutical products were down by 7.0 per cent over the previous quarter. Fabricated metal products and ships, boats and oil platforms were also down, by 3.2 and 2.5 per cent respectively. On the other hand, following a sharp drop in output in the two previous three-month periods, production in basic metals was up by 3.8 per cent in June to August compared with the previous three-month period, while wood and wood products and food products increased by 6.5 and 1.0 per cent respectively.

Month on month output in Norwegian manufacturing increased by 0.8 per cent between July and August 2009 (again seasonally-adjusted figures), so, following a continuing fall since April 2008, industrial output has now risen two months in a row. On the other hand, looked at on a year on year basis, manufacturing output decreased by 7.9 per cent in July 2009 over July 2008 ( working-day adjusted figures).

Housing Boom Coming?

House prices have also rebounded, and have now returned to a peak reached in the summer of 2007, not taking inflation into account, according to Finance Ministry data. House prices rose a quarterly 1.8 percent in the three months ended September, after gaining 5.3 percent in the previous quarter.

Flats in blocks had the largest price increase from the second to the third quarter, rising by 3.9 per cent. The prices of terraced and detached houses were up by 2.5 and 0.8 per cent respectively. Overall, prices increased by 1.8 per cent from the second to the third quarter of 2009, which means that the house prices are now 3.8 per cent higher than in the third quarter last year. While prices of flats in blocks became 6.6 per cent more expensive than in the third quarter of 2008, the prices of terraced houses and detached houses increased by 3.9 and 2.8 per cent in the same period.

Indeed, house prices continued to rise even while the economy was technically in recession since unemployment, which fell to 2.7 percent in September, remained the lowest in Europe throughout the entire credit crisis. Households also received early and rapid benefit from monetary easing earlier this year, since about 90 percent of mortgage holders having mortgages with variable rates. That flexibility boosted demand, with retail sales rising steadily, but also means that rising borrowing costs will bite quite quickly, another reason for preferring fiscal to monetary policy to contain accelerating demand.

Inflation Comes Back To Life

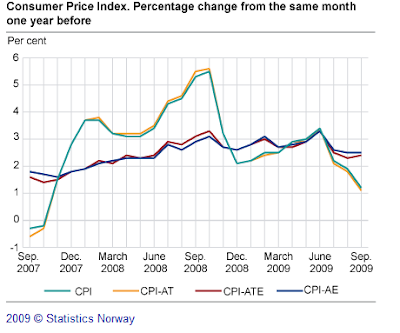

The central bank target for price growth, adjusting for the effect of energy and taxes, is 2.5 percent, and inflation accelerated to 2.4 percent in September from 2.3 percent in Augustt on the banks preferred measure, the CPI-ATE - the consumer price index adjusted for tax changes and excluding energy products - even though year-to-year growth in the standard CPI was just 1.2 per cent, and actually fell 0.7 percentage points from the August annual figure .

Inflation has now exceeded the bank’s target in six out of nine months this year. The bank expects underlying CPI-ATE inflation, adjusted for energy and taxes, to average 2.75 percent this year and 1.75 percent in 2010. They are also forecasting that the mainland economy will shrink 1.25 percent this year and grow 2.75 percent in 2010. The key rate will average 1.75 percent this year and 2.25 percent in 2010, rising to an average 4.25 percent by 2012, according to the bank.

The Krone

Norway's strong growth outlook has helped the krone outperform other regional currencies - like Sweden’s krona - against the euro since the end of March, making the Krone-Krona cross a very attractive one for the carry traders (since Sweden's interest rates are being held at zero). In fact it is precisely this upward pressure on the currency which limits the room for the central bank to hike interest rates going forward, since the non-oil export sector is still struggling and a stronger krone will only weaken make the problem worse. Yet the problem is likely to get worse, since the krone will almost certainly continue to strengthen as the global economy recovers, and especially as risk appetite strengthens

So while the signs of an overly strong recovery may support a rapid reversal of monetary easing, the central bank must balance the needs of the domestic economy against the risks presented since if they don’t respond there will be an overshooting of the inflation target, but if they adjust monetary policy to the fact that fiscal policy is very loose, you will get a stronger krone. As I say, maybe the solution here is to move over to fiscal policy, but still.

Surprise, Surpri-i-se

The problem Norges Bank are going to have can be seen by looking at the chart below, which contrasts an inverted USDNOK with some Citigroup Economic surprise indexes . A surprise index is an instrument which attempts to quantify the extent to which economic indicators in a given country or region surpass or fall-short-of consensus estimates - and this is what really matters, it seems, and is why you get all that additional detail about what "economists" expected to happen in so much of contemporary economic journalism. It is not to help you see whether they were right or wrong, but to help investors and traders see how their peers might respond.

An economic report with better-than-expected data news is assigned, for example, a value of 1, while a report with worse-than-expected data news is assigned, again for example, a value of -1, while a report which just meets economists expectations gets a 0 value. Tally up the values of the reports for any given week, and you have the Surprise Index reading for that week.

Anyway, if you look at USDNOK (inverted, so north on the chart = NOK strengthening), vs the economic surprise indices for US, Eurozone and Norway, you should be able to see - without squinting too hard - how the US and Eurozone indexes show an unsurprisingly good correlation with USDNOK from early this year as the economic data started to turn, and sentiment returned to the markets. Simply put, as US data exceeded expectations, people felt more like borrowing to play around with "risky" (or not so risky really, but then the return isn't too big) assets like debt instruments denominated in Krone. Of course, they were also borrowing to get their teeth stuck in to some more more risky (but attractive) assets like those denominated in Hungarian Forint, or Ruble, or Ukranian Hyrvnia, but I think we can safelyb leave that story for another day. Also what happens to all this the day (which will surely one day arrive) that the indexes start to head south with economic data systematicallty underperforming expectations could also be put to one side for the moment.

The 2009 year to date correlations between inverted USDNOK and the US, Norwegian and Eurozone Eco Surprise indices as 72%, -46%, 77% respectively. Both the US and the Eurozone surprises seem to have been highly correlated to the US and the eurozone data outperformances. But if you look at the chart closely enough, and examine the Norwegian surprise index in particular, you should be able to see that the USDNOK was driven by sentiment derived from upside US and European data, rather than domestic data (so called fundamentals) for most of the year. But now, of course, Norway has been wheeled onto the inflation/interest rate ramp, so it will be interesting to see if the cross starts getting driven more by the domestic side - as investors respond to upside and downside surprises, and their potential impact on central bank monetary policy, and how the consequent decision making process may influence their investor peers. To my largely untrained eye, it looks to me more like things have been moving more this way since Norway started to make central bank headline news at the start of October.

Exports Under Threat

Norwegian exports - like everyone else's - are expected to recover more slowly than consumer demand, according to the main government forecasts, only rising 0.1 percent in 2010 after slumping 6.5 percent this year. In September, goods exports were running at NOK 59.4 billion and imports at NOK 36.8 billion, so the trade balance came in at NOK 22.6. Both exports and imports were up on August, but are still well down on last year.

Imports increased by NOK 3 billion from August, and compared with September 2008 the imports went down by NOK 9.6 billion. Exports increased by NOK 1.4 billion from August, and compared to September last year the exports were down by NOK 13.7 billion. The reduced price of crude oil is the main reason for the decline.

Compared to August, the mean price per barrel of crude oil fell from NOK 445 in August to NOK 402 in September. The exported number of barrels of oil went down 2 million, and crude oil exports declined NOK 3 billion. The price per of a barrel of oil is down NOK 154.6 from September 2008. Although the number of barrels exported rose by 2.1 million or 4.5 per cent compared with the corresponding period last year, the export value of oil decreased by NOK 6.4 billion and ended at NOK 19.8 billion making for a 24.5 per cent reduction.

A similar picture can be observed for the value of natural gas exports which came in at NOK 11.3 billion, or down NOK 594 million from August. The export value of natural gas declined by 1.7 billion compared with September 2008 despite the fact that the quantity of exported natural gas in gaseous state increased by 21.4 per cent. At the same time Norway has a huge current account surplus as a result of the commodity exports and the investments made by the oil and gas fund.

According to preliminary figures, the Norwegian current account surplus was NOK 95 billion in the second quarter of 2009, down NOK 30 billion from the second quarter of 2008. In part this was a result of the drop in the balance of goods and services which at NOK 78 billion was down NOK 54 billion compared to the second quarter last year. There was also a positive net balance of income and current transfers of NOK 18 billion in the second quarter of 2009, compared to a deficit of NOK 6 billion in the same quarter in 2008. The improvement can largely be explained by a rise in net dividends paid from abroad.

Tight Labour Market

One of the Bank's principal areas of concern (and hence one of the key areas of investor interest) is the state of the labour market - “It appears that unemployment over the next few years will remain lower and wage growth somewhat higher than previously projected. This suggests higher inflation, indicating that the key policy rate should be raised somewhat more rapidly than previously projected.”, according to the Norges Bank in its statement. The bank thus projects the key inflation rate will average 4.25 percent in 2012, compared with a June forecast for 3.75 percent.

In fact, despite the use of unemployment as an argument for not withdrawing fiscal stimulus, the government has already lowered its unemplyment forecast for 2010 to 3.7 percent, down from the 4.75 percent seen in May. But such rates are considered high, and are politically sensitive in Norway, since the country has one of the lowest trend unemployment levels in Europe.

Certainly domestic employment has been falling, and from May to August the number of employed persons decreased by 22 000. The unemployment rate was 3.2 per cent of the labour force in August. The reduction in employment is mainly within the age group 16-24. The seasonally-adjusted unemployment increased by 1 000 persons from May (as measured by the average of the three months from April to June) to August (as measured by the average of the three months from July to September).

Favourable Demographics

Noway's underlying demographic dynamics are actually quite favourable - the Total Fertility Rate, for example, stood at 1.78 in 2008, and population momentum is still quite strong, increasing by 13,400 in the second quarter. In part this increase is due to an excess of births over deaths of 6 400, but there is also a net migration component of 7 000. Compared to the same quarter last year, there were 2,400 fewer immigrations and 550 more emigrations. The migration surplus came to 7,000, which was 2,950 less than in the second quarter last year. The largest migrant group is from Poland, and compared with the second quarter last year, 45 per cent (or 1 700) fewer Polish citizens went to Norway. Other large migrant groups come from Germany, Sweden, Lithuania and Eritrea.

During the first six months of the year, 29,700 persons immigrated to Norway, 2,700 fewer than last year. In the same period, 13,150 emigrated from Norway, 3,100 more compared to last year. This adds up to a net migration of 26,300 for the whole country, which is 5,800 lower than the previous year. As can be seen, one way to take some of the pressure off the labour market, is by facilitating inward migration, and the Norwegian authorities seem to be well aware of this. It is also a good way to make the health and pensions system much more sustainable as population ageing takes its toll.

Uneven Global Recovery

As we are seeing, one of the problems Norway faces, as a small open economy, is the very unevenness of the global recovery. I would even go so far as to say that this is going to be one of the defining characteristics of the stage we have now entered, where differences will be more important than similarities between economies. As we have seen in the case of France, and as we are now seeing in the case of Norway, one critical factor is who can generate autonomous domestic demand, since it is this that will offer the key to successful stimulus programmes.

The monetary tightening process is likely to be slower in countries with more fragile recoveries while other central banks become well advanced in thinking about “exit strategies” and how to unwind exceptional measures taken to combat the crisis. Now Carsten Valgreen, Chief Economist at Danske Bank in an important (but rather neglected) paper in 2007 (The Global Financial Accelerator and the role of International Credit Agencies) put some of the problems Norway is facing like this:

The choice major countries have made in the classical trilemma: ie, Free movements of capital and floating exchange rates has left room for independent monetary policy. But will it continue to be so? This is not as obvious as it may seem. Legally central banks have monopolies on the issuance of money in a territory. However, as international capital flows are freed, as assets are becoming easier to use as collateral for creating new money and as money is inherently intangible, monetary transactions with important implications for the real economy in a territory can increasingly take place beyond the control of the central bank. This implies that central banks are losing control over monetary conditions in a broad sense. Historically, this has of course always been happening from time to time. In monetarily unstable economies, hyperinflation has lead to capital flight and the development of hard currency economies based on foreign fiat money or gold. The new thing this paper will argue is that we are increasingly starting to see the loss of monetary control in economies with stable non-inflationary monetary policies. This is especially the case in small open advanced or semi-advanced economies. And it is happening in fixed exchange rate regimes and floating regimes alike.

Valgreen's paper presented two examples to illustrate the issues, and these examples - Iceland and Latvia - are not without their own significance. In both cases local central banks had trouble controlling developments in monetary conditions, as lending from foreign sources in local and/or foreign currency crowded out the efficacy of domestic monetary policy. Despite the differences between the two countries, there was a common story - in both cases monetary policy became increasingly impotent as the central bank money monopoly got to be an increasingly hollow tool. It is no accident that the two examples are small open economies with liberalised financial markets. Being small makes the global financial markets matter more. As we are seeing now a country such as Norway is among the first to notice that the agenda for monetary policy has changed, as both the current and capital accounts are naturally very large and important for the economy.

Clearly, given Norway's very sound fundamentals, and the huge Current Account surplus the country enjoys, there is little likelihood of it becoming an Iceland or a Latvia, but this does not mean there are not monetary policy problems and risks, and it does not mean there is not much to be learnt from studying the Norways of this world, as following them might well show us something of what is in store for larger economies as the global economy recovers. Ignoring the issues which Norway presents would be little better, why not say it, than simply knocking on wood.