I am sure that most of my readers are aware that Iceland, to a somewhat greater extent than the rest of us, are subject to the forces of nature. Being severed by the mid-Atlantic ridge which is a constructive tectonic plate margin cutting across the Atlantic ocean is consequently not for the faint of hearts. In modern times the skirmishes of Surtsey 1963 and Heimaey 1973 are omnious cases in point. As far as I am informed the tectonic activity in Iceland is relatively subdued at the moment but that, as we shall see, does not mean Iceland is not faced with a potential eruption. This time only, Iceland is subject to the equally potent forces of global financial markets rather than the whims of mother nature. In many ways, the sudden return by Iceland to the spotlight is not surprising. As early as in the Spring of 2006 we discussed whether Iceland were among the first in line to suffer a blowout on the back of an abyss deep current account deficit driven by a housing and consumer credit boom and a subsequent vulnerable currency. Here at GEM we have, since the credit turmoil began, been looking wearily towards the Eastern European edifice for the first potential macroeconomic fallout in the context of what we could call emerging economies. I still am but given the most recent events it could indeed seem as if Iceland is about to beat the collective of the CEE and Baltic countries to it. At the heart of the debacle in Iceland lies the same kind of imbalance as we are currently observing in the US as well as other countries around the globe. A large current account deficit coupled with high inflation at a time when the housing bubble and consumer credit boom is about to come to a very abrupt standstill are all ingredients which we should be well aware of at this point. As can be expected this has also taken its toll on the financial sector which has played a seminal role in the recent Icelandic expansion. In this way, Iceland's three largest banks (Kaupting, Glitnir, and Landsbanki) have all seen their credit rating being scythed by the rating agencies recently. In one of their recent much appreciated daily digests Eurointelligence reports how credit default swaps have risen to alarming levels even if we should note that the three big Icelandic banks have branches in mainland Europe allowing them to potentially knock down the ECB's door for liquidity.

(...) the FT reports that credit default swaps for Icelandic banks have risen to extreme levels, for example to 912bps for Kaupthing. The article also makes the piont that Iceland’s three top banks, Kaupthing, Landsbanki and Glitnir, have branches in mainland Europe, which means they can tap the ECB for funding.

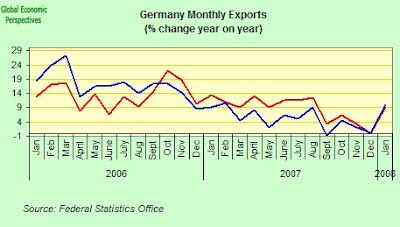

The rather precarious situation of the Icelandic economy recently prompted the central bank into pulling a reverse Bernanke as it was decided at an emergency meeting to raise the main refi rate by a healthy 1.25% bringing it to 15% in total. The immediate impetus for the move were indeed the global financial turmoil and by derivative the fact that the Icelandic krone had, in the past weeks, taken a flogging which would make the buck look like Cassius Clay in his prime. The chart below provides a sniff of the situation at hand as it shows the nominal exchange rate of the EUR/ISK as an index with 2.1.2006=100. As can be seen the recent weeks' turmoil have more than halved the nominal value of Iceland's currency vs the Euro (click on picture for better viewing).

Yesterday the FT furthermore reported how the central bank and the government would move in tandem to shore up short term market liquidity, in part, by issuing €80m worth of short-term bonds. Whether this will work as a remedy to hold off the immediate crisis is basically impossible to tell. At the moment the only thing we can really do is to sit back and look where it will pop first. In the short term Iceland, with its floating currency, obviously seems more inclined to go to the pillory than many Eastern European countries who have pegged their currency to the Euro. We should however, in this context, never let our glance stray away from Hungary who recently was 'forced' to lift its trading band on the Forint. Over at the Hungary Economy Watch Edward and me are following the situation closely. We could also, I think, ask with some validity whether it is really such an advantage for many of the Eastern European countries to have married themselves with the Euro in the sense that this was done in first place on the expectation of future membership of the EMU. At this point this consequently seems all but a fool's hope for most of the countries in question I would argue.

Yesterday the FT furthermore reported how the central bank and the government would move in tandem to shore up short term market liquidity, in part, by issuing €80m worth of short-term bonds. Whether this will work as a remedy to hold off the immediate crisis is basically impossible to tell. At the moment the only thing we can really do is to sit back and look where it will pop first. In the short term Iceland, with its floating currency, obviously seems more inclined to go to the pillory than many Eastern European countries who have pegged their currency to the Euro. We should however, in this context, never let our glance stray away from Hungary who recently was 'forced' to lift its trading band on the Forint. Over at the Hungary Economy Watch Edward and me are following the situation closely. We could also, I think, ask with some validity whether it is really such an advantage for many of the Eastern European countries to have married themselves with the Euro in the sense that this was done in first place on the expectation of future membership of the EMU. At this point this consequently seems all but a fool's hope for most of the countries in question I would argue.

I don't think it would be timely at this point to downplay the potential fallout facing Iceland and as Macro Man aptly noted a while back; you cannot spell risk without 'ISK.' As always in these kind of situation the main risk is that markets call the authorities to the poker table in which case the central bank's reserves are certain to be drained faster than many investment banks' balance sheets are currently being re-furnished. Given the size of the Icelandic economy such a move would likely be nasty, brutish and short. I don't know whether all those loans in Iceland are denominated in Euros which would clearly represent a substantial degree of translation risk but even without this issue the situation is still getting increasingly more precarious. Obviously, not all view it this way and we would be well advised to pay attention to the following as quoted from the FT ...

Richard Portes, president of the Centre for Economic Policy Research, and the author of a respected report on Iceland’s economy last year, has urged investors to pay more attention to the data. He points out overheating is being tackled, with economic growth slowing, hitting 2.9 per cent in 2007 and zero this year. He adds that Iceland’s current account deficit – the source of many of the concerns about the economy – has narrowed from 26 per cent of GDP in 2006 to 16 per cent in 2007. He has also made clear that Iceland’s banks are sound by international standards, with deposit ratios in line with international norms, high capital adequacy ratios by European standards and credible funding profiles. Finnur Oddsson, managing director of the Icelandic Chamber of Commerce, said: “The global turmoil is certainly hurting the financial sector, but the danger of things toppling over here is greatly exaggerated.”

What we have here is analogous to the debate we are having in the context of Eastern Europe and whether the landing will be hard or soft? Definitions as always are important here but it is obvious for anyone with a basic understanding of macroeconomics that having a floating currency also yields to potential of actually correcting the external balance without resorting to deflation something which the Baltics et al. may soon realize. Obviously, the flipside as should be clear from the oveview presented above is that the correction is too swift thus bending the stick so far that it ultimately break. Moreover, and as we are seeing in Hungary the traditional correction by which an undervalued currency boosts exports is not likely to cut it if inflation stays high (i.e. eroding the competitiveness) and the income flows on the current account pulls the balance further down as a result of an overweight of foreign owned domestic assets relative to domestic investors' foreign assets. Whether this applies to Iceland is dubious. More than anecdotal evidence suggests that Icelandic investors and money men have been active in particularly Scandinavian asset markets. Moreover, and if you accept the fact that Hungary's and indeed the whole Eastern European situation has something to do with the fact that these countries have moved(still moving actually) through the demographic transition far quicker than the traditional economic development process has been able to keep up I think we have a good basis for analysis. This thus leads me to the point I should perhaps have started with, namely a long term and structural assessment of the Icelandic economy. You should not worry though as I have all my bases covered. It would thus serve us well to go back to May 2007 and have a look at my colleague Edward Hugh's piece on Iceland posted at Global Economy Matters. In this note, Edward indicates why any worry about Iceland in the long term and from a structural point of view seems to be largely unfounded even if of course the imbalances themselves run the risk of causing an abrupt crisis. In fact, Edward lifts a quote from the Economist Intelligence Unit where the specific risk from financial markets and potential spillover effects into the currency with a subsequent wage-inflation spiral to follow are mentioned. This would then be where we are situated now but allow me still to quote Edward in his final remarks ...

So is this really so bad as it seems? Well let's revisit an argument Claus advances in his recent French post, which is that if some countries with high median ages are now structurally tied to dependence of exports for growth (and sustainability in their public finance), then logically other countries (with somewhat lower median ages) are going to need to run ongoing trade deficits. Claus was referring to France in its ongoing relationship with Germany, but the argument could easily be extended to Iceland and points further afield. Iceland still has a median age of around 34 years, which makes it a very young country in developed economy terms. So if we can apply Modigliani's Life Cycle Hypothesis to populations in the case of the elderly economies (Japan, Germany, Italy, Finland etc), why shouldn't we apply the same notion to the relatively more juvenile economies, who can with some greater realism accumulate liabilities now which can be paid off later, as the population ages and domestic saving increases? I know this as all somewhat politically incorrect, but I do worry just exactly what would be the impact on overall economic welfare of all the younger median age societies bringing their economies into trade balance, since the level of ongoing global growth would obviously be lower, and I am not really convinced that this would be especially desireable as an end result.

I certainly have no idea whether Iceland is about to go but given the recent events investors would be wise to keep an eye out. Moreover, any longterm structural bullishness on Iceland clearly need to take the proverbial part as wing man in what is about to unfold since at the moment it is all about animal spirits as Keynes famoulsy articulated it. To end, after all, on an analytical note I would argue that the underlying external position of Iceland seems to be in a better shape than the ones we are seeing in Eastern Europe but that does not mean that any rapid adjustment won't be tough since the size of Iceland's economy virtually gurantees that it would be a swift kill for risk averse international investors and punters alike.