By Claus Vistesen: Hull

One of the reasons that I have always had a problem with Goldman Sachs' infamous notion of the BRIC economies was not the fact that it excluded other important economies such as e.g Chile or Indonesia, but rather that Brazil, India, Russia and China never belonged in the same group. The reason for this is largely because of demographics. Both Russia and China are consequently set to age much more rapidly than India and Brazil due to very rapid fertility transition in the 1990s. The demographic situation is especially dire in Russia which not only saw a dramatic and lingering decline in fertility in the 1990s but also saw a corresponding increase in mortality (aids and alcohol as big culprits).

A recent piece by Carl Haub suggests however tha while doom and gloom used to be the prevailing tone on the state of Russian demographics recent trends suggest that this should change.

Back in 2000, Russia achieved what Russians consider a dubious milestone, deaths (2,225,300) outnumbered births (1,266,800) by an astounding 958,500. The crude birth rate had sunk to 8.7 births per 1,000 population. Along with a crude death rate of 15.3, natural increase hit an all-time low of –6.6 per 1,000, or –0.7 percent rounded off. The total fertility rate (TFR) bottomed out at 1.195 children per woman. The crisis, as it was seen to be, was definitely noticed, but nothing really effective was done until 2007 when Vladimir Putin announced a baby bonus of the equivalent of $9,000 for second and further births. Putin has been an outspoken advocate for raising the birth rate and improving health conditions in order to avoid the consequences of sustained very low fertility. The program must have worked since births in 2007 jumped to 1,610,100 from 1,479,600 the previous year and have rising ever since. This is one of the very few “success stories” in the industrialized countries’ efforts to raise the birth rate.

Together with the rest of Eastern Europe that was re-joined with the West after the fall of the Soviet Union, Russia experienced one of the most brutal fertility transitions ever seen. Indeed, history seems to have been extraordinarily cruel to many countries in Eastern Europe in handing them a second chance at the end of the 1980s just to take it away with the other hand as their demographic fundamentals collapsed. The birth dearth in the East even stretched into Eastern Germany where the total number of live births fell from 215700 to 88300 in the period 1988 to 1992.

I have previously mused that perhaps those multinationals eager to expand eastwards would have to go all the way to Kamchatka to find qualified labour and perhaps even fail entirely and back in 2006, the only silver lining that the Economist's Berlin correspondent could find was how a residing population had led to a revival of wildlife with the lynx returning to Germany's Eastern borders.

Perhaps though, it is time to put this discourse to rest?

Russia in Transition

From 1989 to 1999/2001 the total fertility rate in Russia fell from replacement levels to around 1.1/1.3 and notable effort [1] has been put into explaining why birth rates fell so much, so quickly.

Grogan (2006) uses a household survey tracking data from 1994 to 2001 and finds that a large part of the decline in fertility among married couples can be attributed to the decline in household income in the same period. Grogan (2006) however also sheds light on other aspects of Russia's fertility during the Soviet era. In particular, the paper sets out to explain completed cohort fertility for women born between 1936 and 1961 and finds that women with higher education had considerably lower completed cohort fertility rates than their counterparts. This squares well with the notion of the quantity/quality tradeoff of fertility famously developed by Gary S Becker [2] and how parents substitute quantity for quality as their income levels rise (with education), but it comes with an important twist in the Russian case. Since female labour force participation was almost universal during the Soviet era and since women with less than higher education often earned the same (or more) than their better educated peers, Grogan (2006) seems to imply an inherent demand, by part of well educated women, for quality rather than quantity in their fertility decisions.

The other driver of fertility decline in the form of the tempo effect is also present in Russia, but Grogan (2006) is skeptical as to its merits in explaining the sharp fall in fertility in the 1990s. It does appear to coincide with a change in attitude towards marriage and, specifically, births outside marriage, but from 1988 to 2000, mariage rates declined for the broad category of women (aged 15-44) as well as the share of total live births taking place outside marriage rose from about 14% to 26%.

In essence, the tempo effect over the period in question is not linear and seems to neutralize itself over time.

From 1989 to 1994, the share of births to mothers under 20 actually rose and then declined to just above 1989 levels in 2000. Not surprisingly, the share of total non marital live births among mothers aged less than 20 years rose sharply from 1989 to 2000. This suggests that the extent to which non-marital live births increased, it resulted in children being borne to young mothers. From a theoretical perspective, this is important in relation to how a change in the life course towards postponing marriage also leads to a postponement of childrearing. A norm of non-marriage child births may then serve to weigh against the tempo effect of fertility.

This non-linearity of the tempo effect throughout what was essentially a sharp linear decline in fertility is interesting. The charts produced in Grogan (2006, p. 65 fig XI) clearly suggests that from 1989 to 1994 total live births for young mothers aged under 20 as well as those from 20-24 rose as share of overall birhts. This reverses somewhat in 1994 where live births for mothers aged 25-29 starts to increase as well as those aged 30-34. Yet Grogan (2006) notes that since there is no meaningful change in the fraction of total live births of "older" mothers in 2000 relative to 1989, the decline in fertility in Russia is not a postponement phenomenon.

Brainerd (2006) builds on the points above by similarly latching on to the idea that the economic hardship bestowed on Russian citizens in the 1990s contributed to the decline in fertility. This suggests again a more permanent negative quantum effect at work rather than merely a postponement phenomenon. But the underlying causes of the fertility decline is cut very finely by Brainerd (2006). Notably, the paper argues for a pure negative income effect on birth rates and thus a reversal of the standard quantity-quality tradeoff as developed by Becker. The interesting thing here is that little evidence is found that general macroeconomic uncertainty (of the future) affect fertility even if women with more negative expectations of the future had a higher propensity of abortion.

Quantitatively, Brainerd (2006) finds strong evidence for how marriage and a higher income per capita positively affects fertility using a fixed effect estimation with age specific fertility rates as dependent variable. Since marriage rates and income declined in the period 1989 to 1999, it leads to the conclusion that this caused the decline in fertility. I find this plausible, but would note that the estimation results suggests that underlying uncertainty of the future might still be affecting these results. For example, Brainerd (2006) shows how the effect of income on fertility is strongest for young mothers which indicates that permanent income may be a more useful proxy for linking fertility to income levels than the traditional method of using fluctuations in current income. It also sugggests that the income effect might be lower over time in the aggregate if we assume a general process of postponement, but this is dubious in Russia's case following Grogan (2006).

And now lets go make some kids ... ?

In general, the tendency of non-marital births is interesting to dwell on and Perelli-Harris (2008) [3] draws a sharp distinction between two reasons to explain it. The first relates to the notion of the second demographic transition [4] which postulates that the extent to which non-marital births occur in stabile cohabitations, as e.g. in the Scandinavian countries, it reflects a change in value towards marriage and thus a change in the life course. Contrary to this stands evidence, largely from the US, that non-marital births are associated with much less stable unions and, generally, poorer levels of society.

Not surprisingly, Perelli-Harris et al (2008) do not ascribe either of these explanations to the rise of non-marital fertility in Russia, but rather; a mixture of both. One important aspect here is the extent to which, after a non-marital contraception, women with higher education tend to enter into marriage with a much higher probability than women with lower education. But everyone will be able to find sources to support their argument with for example this article by Sergei V. Zakharov and Elena I. Ivanova arguing for a more traditional second demographic transition process in Russia.

One overarching conclusion which emerges on the fertility decline in Russia is that it was not driven primarily by birth postponement but seems to have been pushed by a more lingering quantum effect. The more specific driving forces of this quantum effect is much more difficult to get a hold on, but from the perspective of the macroeconomist it appears as if Russia entered a sinister spiral of increasing mortality and declining fertility just as the economy was meant to rebuild and then later take off on the much hailed wave of convergence. In particular, it appears as if the general adverse economic environment in Russia in the 1990s may have caused fertility rates to "undershoot".

Pro-natalism in Russia, Action and Reaction?

While we may certainly look upon Russia's demographic experience as a frightening example of the effect of negative population momentum, it would be unfair to say that the Russian leadership has been sitting idle. In 2006, Vladimir Putin announced a number of pro-natalist initiatives targeted at reversing the the decline of Russia's population. The plan included longer maternity leave, increased child benefits and most notably a full USD 9000 payment to women opting to have a second child Brainerd (2006).

In May 2009, president Medvedev arranged for eigth families to be courted at the Kremlin where they were awarded the Order of Parental Glory; the Levyokin family chosen to represent the Moscow region had, at the time, given birth to no less than 6 children.

Getting his Priorities Straight

The question is whether it has worked?

According to Carl Haub it has (see above), and if this is indeed one of the few success stories of how ageing economies can reverse their birth rate, it is worth paying more than scant attention to. The data here is subject to some uncertainty, but following Haub's lead the total fertility rate in Russia stood at 1.54 in 2010 which is up from a low point of 1.2 in 2000. In addition, Haub notes an important distinction between rural and urban fertility rates with the former standing at 1.9 in 2010 and the latter at 1.42. This last point is difficult to underestimate since it shines a rather pessimistic initial light on the strides to increase fertility in Russia. In particular, it casts russia in a more classic emerging market context witha a very abrupt quantity/quality trade-off at work whereby especially urban fertililty undershoots significantly below the replacement level.

Still, the aggregate picture is improving.

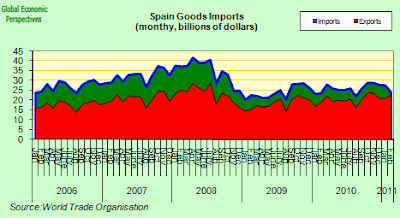

(click on charts for better viewing)

In the jargon of the profession we must now be seriously asking whether Russia is about to join the very few nations that has managed to break free of the fertility trap defined here as how total fertility rates often don't recover (or has not recovered yet!) once they fall below 1.5. The only two other countries which have seen their fertility levels rebound from below 1.5 are Denmark and France.

I would happily announce that this is the case, but the plot is just about to thicken.

On the positive side and given evidence from the academic literature that the tempo effect is not a relevant phenomenon in a Russian context, it stands to reason that this rebound can be interpreted as a real change in sentiment towards having children.

Score one for Russia's pro-natalist policies then?

To some extent though Carl Haub pours water on this idea noting that the second derivative of the fertility increase is falling which leads him to ponder whether the rise of Russian births is losing steam. This argument is taken further by Kumo (2010) [5] who suggests that not only did Russia's pro-natal policies not work in the first place, but also that the rise in the number of births can be attributed entirely to fluctuations in the number of women in their reproductive age. More importantly however, Kumo (2010) emphasizes the difficulties of micro managing fertility and specifically the issue of just how difficult it is to get a lasting impact on fertility from cash transfers. In short, empirical evidence shows that pro-natalist policies rarely have a permanent effect. This is even more likely to be significant in a Russian context as the fund set up to dole out money to fertile mothers expires in 2016.

Ageing in Russia, Adjusting for Mortality

To assume that the Russian government's attempt to push up fertility rates will have a lasting permanent effect is probably as dubious as assuming that it will have no effect at all. In addition, if Russia is serious about securing a future balanced population pyramid, what is to say that there won't be more initiatives?

Still, it appears that just as Russia seem to be making strides in the fertility department, the appalling situation for adult male mortality continues to taint the overall picture. Here, the optimists will call foul play and point out how the main story on Russian demographics has recently been a co-movement of improving mortality and fertility rates. This may be true, but overall conditions are still poor.

According to data from the World Bank only a mere 47.4% of a male cohort can expect to celebrate their 65th birthday which contrasts with 78.5% for women. On average (from 1998 to 2009) only 44.5% of a given male cohort could expect to reach 65 years.

Despite the visible improvement since the mid 2000s, the evidence from a birds eye view has not changed. Male life expectancy seems to be mean reverting around 61 to 62 (at birth) and mortality for adult males exhibits an increasing trend. An afinity to Vodka and other spirits as well as too many cigarettes appear to be lingering killers. Recent research (2009) from the medicinal sciences using mortality patterns from Tomsk, Barnaul and Biysk suggests alcohol was a cause of more than half of all Russian deaths at ages 15-54 years.

As a result, the natural increase is still negative as the up-tick in births has still not managed to pip the mortality rate here even if it seems a more lasting change may be underway here.

A Rare Sight

Regardless of the permanency of recent years' improvement in fertility Russia cannot escape a rapid process of ageing. More than anything, this is why I so ardently argue against lumping Russia together with India and Brazil or more specifically; in Russia there is no positive demographic dividend in sight; rather what we have is a negative one.

Of course, we cannot simply assume that the Russian population will fall from here on as one would assume (and hope) that Russia manages to reverse the trend in mortality. What we can see however is that in terms of the prime age group (35-54), Russia is likely to have peaked already in 2004 even if the effect of the double hump is interesting to consider (a result of assuming a perpetually declining population).

In addition, the process of ageing means that there is almost no chance of Russia being able to contribute to global rebalancing by sustainably running an external deficit. This is one of the single most important macroeconomic characteristics which suggests why we should not label Russia as an "emerging" economy. Russia and the CEE will instead be fighting to escape the mantle that they may just have grown old befor they made it to become rich.

Especially the younger part of the labour force will invariably be subject to a swift decline and the composition of the labour force is crucial to consumption smoothing on the aggregate level and thus capital flows.

However, the most important aspect in the context of ageing in Russia is to adjust for the continuing high mortality rate among men. In a recent piece in Sciencemag Warren C. Sanderson and Sergei Scherbov argue that we should rethink ageing given that as the world population ages so does the threshold at which we can consider a person (or population) to be "old".

(...) as life expectancies increase and people remain healthy longer, measures based solely on fixed chronological ages can be misleading. Recently, we published aging forecasts for all countries based on new measures that account for changes in longevity (5–8). Here, we add new forecasts based on disability status. Both types of forecasts exhibit a slower pace of aging compared with the conventional ones.

This makes perfectly good sense and governments around the world are busy pushing up retirement ages to reflect this, but does this apply in a Russian context? What good would it do to push up the retirement age in Russia if less than half of a male cohort makes it to 65? The principle applied by messieurs Scherbov and Sanderson cuts both ways and in Russia's case we must incorporate an additional accelerant in our analysis of ageing to account for the continuing high rate of mortality and indeed an effect which will take some decades to pass through the pyramid.

Something Stirring in the East?

The recent improvement in Russia's demographic indicators begs the question of whether the glass is half full or half empty. On the former I would note two things. Firstly, Russia has indeed seen a noticeable improvement in both fertility and mortality and it seems to have coincided with the government's strategic aim to actually do something about the country's decaying demographics. Secondly, I will salute the effort in itself. We can all probably agree that Russia has veered a little too much towards the way of authoritarianism under Putin, but whatever the underlying ambitions to push forward a positive population agenda I think it is extraordinarily important.

On the latter however, I am still worried that the trend in mortality have not been reversed and that, if anything, the situation is improving all too slowly. I am open to a more positive spin, but the data and an, admittedly scant, look at the evidence gives little comfort. As a result, ageing in Russia will be much more acute and its effect will have a much larger and negative impact than if life expectancy was a steadily increasing function of time. Indeed, given the continuing poor state of especially male health in Russia it is questionable whether the measures above of "peak growth" apply at all.

The most important feature of Russia's demographic rebound is its potential permanency and especially we should watch whether Russia manages to stay above a fertility rate of 1.5. If this turns out to be case, we could harbour a hope that not only lynxes but also a rejuvenated Russian population may be stirring in the East.

---

* All photos in this essay are taken from Creative Commons License accounts at Flickr. Data for the charts are from the World Bank Database and US Census Bureau (long term population forecasts).

[1] - In the following I will make extensive use of Louise Grogan (2006) - An Economic Examination of the Post-Transition Fertility Decline in Russia and Elizabeth Brainerd (2006) - Fertility in Transition: Understanding the Fertility Decline in Russia of the 1990s.

[2] - Becker, G. (1960) - An economic analysis of fertility, In Demographic and Economic Change in Developed Countries. NBER: New York

[3] - Perelli-Harris, Brienna and Gerber, Theodore P. (2008) Non-marital fertility in Russia: second demographic transition or low human capital? In, Population Association of America 2008 Annual Meeting, New Orleans, US 17 - 19 Apr 2008. , 33pp.

[4] - The second demographic transition has many sources but these ones by Dirk J. van de Kaa are a good starting place.

[5] - Kazuhiro Kumo (2010) - Explaining fertility trends in Russia, VOX EU