Only one thing is really clear about the Germany economy at the present time, and that is that it is shrinking rapidly. In fact it contracted far more than most analysts and observers expected in the third quarter (although I, for one, was not especially surprised), entering what now appears to be its worst recession in at least 12 years as both exports and domestic spending continue to fall. German gross domestic product in Q3 dropped by a seasonally adjusted 0.5 percent from the second quarter, when it fell by a quarterly 0.4 percent, according to revised data from the Federal Statistics Office. The Germany economy last had a two quarter contraction of this magnitude back in 1996.

And all the signs are that the fourth quarter will be worse than the third one, so the situation may even surpass the 1996 recession.

What's more the 2009 outlook promises to be even worse. The International Monetary Fund are now forecasting outright GDP contractions for the U.S., Japan and the eurozone next year, with Germany's economy expected to shrink by at least 0.8 percent (this as we will see is one of the most optimistic forecasts currently on the table for German GDP next year). The European Commission declared the 15-nation eurozone to be in recession in November, and just over 40 percent of the exports from this highly export dependent economy go to other eurozone nations.

The only positive elements in the Q3 GDP data are to be found in the slight increases in both final household consumption and government expenditure. On a seasonal and calendar-adjusted basis, household consumption expenditure rose by a quarterly 0.3%, while government final consumption expenditure rose 0.8%. Gross fixed capital formation rose slightly (0.1%) due laregly to a sharp uptick in construction over the second quarter (+0.3%, following –3.4% in the second quarter and +5.5% in the first).

In addition there was a large increase in inventories, and inventories contributed a whopping 0.9 percentage points to Q3 growth (see chart below), and without this build-up the contraction would have been much sharper - so watch out since this inventory increase which will more than likely be unwound in the fourth quarter, with considerable downside impact. Imports were up significantly (largely due to the rise in oil prices - oil peaked around $147 a barrel in July), while exports dropped, as a consquence movements in the net trade balance had a negative impact on final GDP.

Capital formation in machinery and equipment (ie investment) was down sharply (–0.5%), after increasing for seven quarters in a row. Thus the entire positive impact of domestic consumption and increased inventories was more than offset by a very rapid and sharp deterioration in the net export position. Between July and September exports were down by 0.4% over the previous quarter, whereas imports were up 3.8%. This meant that net exports contributed a whopping minus 1.7 percentage points to q-o-q GDP, and headline German GDP is extraordinarily sensitive to changes in the net trade position (see chart below).

Deteriorating Short Term Outlook

Looking forward into Q4, the signs, as I said, are for deterioration, as can be seen from the fact that (according to the latest flash PMI) German services contracted for the third consecutive month in December, even if the rate of contraction was slightly less than that in November.

Worse still, the contraction in manufacturing accelerated, and sharply so, clocking up its fifth consecutive month of contraction according to the flash estimate. The data released by Markit Economics showed German manufacturing registering its lowest reading for manufacturing since the survey was started in April 1996, with the indicator falling to 33.5, down 2.2 points from the November result and significantly exceeding the 1.3 point decline expected by the analysts. If we break the figures down we find that output tumbled all the way to 29.9 (from 32.3 in November), while new orders slipped 3.3 points to a record low of 25.8. Meanwhile, the employment component reached its worse level in the history of the index, coming in at 40.9 for the month from November's 43.6.

October Industrial Output Down

The PMI data are obviously only survey-based forward-looking estimates, but when we come to the actual data we find they are normally pretty near to the mark, since German industrial output fell strongly in October - dropping a seasonally adjusted 2.1 percent from September - according to the latest data from the Economy Ministry. Year on year working day adjusted output fell 3.8 percent. And November’s drop was led by a 3.1 percent month-on-month slump in the demand for investment goods, which means that companies are anticipating a serious slowdown in final manufactured goods further on down the line.

And the PMI is Confirmed By New Orders Data

I think nothing gives us a clearer illustration the dramatic nature of the industrial slowdown the Germans are now experiencing than the chart reproduced below which shows changes in monthly orders (both domestic and for exports) for German manufacturing industry over the last decade. As you will see (to use one of my choice phrases of late) we just went careering off a cliff.

New manufacturing orders dropped 6.1% in October from September, and in September they fell 8.3% from August. The quarter on quarter drop is huge - in the order of 40%.

Export orders are falling faster than domestic ones in the longer term during Sepetmber even domestic orders started to contract sharply as well - a 6.1% drop as compared to 6.2% for exports. What this suggests that the "second round effects" on domestic consumption from the drop in export sales are now hitting domestic manufacturing order books.

Exports Up Only 1.4% In October

Now it is, I think, generally accepted that German domestic demand is lacklustre, and has been for some years, and the German economy lives (or dies) from exports, so it is not without importance that according to the most recent provisional data from the Federal Statistical Office, October German exports were worth up only 1.4% (non price adjusted) and imports up 5.4% from their respective October 2007 levels. After calendar and seasonal adjustment, exports in fact decreased by 0.5% (and imports by 3.5%) month on month when compared with September.

The foreign trade surplus was 16.4 billion euros in October 2008, down from the October 2007 surplus of 18.9 billion euros.

Growth Outlook

It is very hard to put precise numbers on where the German economy is likely to go from here. Certainly GDP growth next year is going to be a shocker on the downside - with or without those notorious calendar adjustments. The Essen-based RWI economic institute are forecasting what now seems to be a "low end" prediction of a 2 percent contraction for next year, but even this would already be the biggest annual contraction since World War II. The have been joined by the IFO institute, who foresee a contraction of 2.2%. At the present time everyone is moving on the downside and accepting the reality of what is happening, with the Berlin-based DIW economic institute also cutting its forecast for the final quarter of 2008 to a contraction of 0.3 percent - down from previously anticipated growth of 0.2 percent (citing in justification the declines in industrial output and construction). The Kiel-based IfW suggested this week that the German economy will shrink 2.7 percent next year - the most pessimistic assessment by any leading research institute. Worse they are suggesting that equipment investment will drop 7.4 percent in 2009 (following a 4.9 percent this year) and that exports will decline 9 percent, (compared with an estimated gain of 5.1 percent in 2008). If these last two guess-timates are anywhere near right, then the German 2009 contraction will be very significant indeed, since exports are the key to the functioning of the German economy.

According to a report in the Frankfurter Allgemeine Zeitung earlier this month the Germann Economy Ministry currently estimate that the economy may shrink by as much as 3 percent next year.

Even further along the scale there is Deutsche Bank, who are forecasting a contraction of as much as 4 percent next year. Deutsche Bank chief economist Norbert Walter makes his forecast based on the deteriorating economic situation in Russia and in the Middle East, countries which have been vital in sustaining demand for German exports in recent months. As a fair weather pessimist on the German front, I feel that Walter may be near the mark than most, and my reasoning would be based on the severity of the downturn both in Russian and Eastern Europe, as well as the slump in Southern Europe, lead by Spain's sharp and resonant housing crash. Since these regions collectively are customers for a very sizeable part of German exports, I expect a pretty horrendous H1 for German GDP in 2009 - and the bad news could go on a good deal longer, since I am sure the East and Southern European agonies are going to drag on at least int0 2010.

Business Confidence Plummets

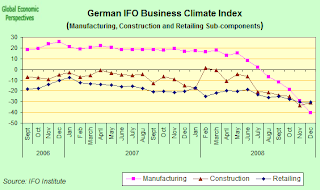

Certainly the omens for Q4 2008 are now clear enough. German business confidence has been falling sharply since the summer, and dropped to its lowest level in more than of a quarter century in December. The Ifo institute business climate index, which is based on a survey of 7,000 executives, fell to 82.6 from 85.8 in November, giving the main index lowest reading since November 1982. The drop was largely a product of a significant fall in the current economic situation component - which fell to 88.8 from 94.9 in December. Expectations remained largely unchanged at a very low level.

The main sub components all remained very low in December,but what is most striking is the rapidity of the deterioration we have been seeing in the manufacturing sector.

German consumer confidence has held up rather better (possibly a function of the resilience of the labour market, and the drop in inflation) and has remained largely unchanged following a fairly sharp deterioration in August. In December growing pessimism about the short term economic outlook was offset by a stronger willingness to buy, and GfK AG’s forward looking index for January, based on a survey of about 2,000 people, held steady at 2.1.

Employment Resists The Downturn

German unemployment continued to drop in November, despite the scale of the recession that just hit the country, and employers continue to retain and even recruit staff while orders slump. The number of people out of work, adjusted for seasonal variations, dropped a further 10,000 in November to reach 3.15 million, following a 26,000 fall in October, according to data from the Federal Labor Agency. The seasonally adjusted unemployment rate held steady at 7.5 percent, a 16- year low.

Meanwhile separate data from the Federal Statistical Office show that in October 2008 there were 40.84 million Germans in employment, an increase of 538,000 (or 1.3%) over October 2007 . In facr this was the highest number of Germans employed ever. Month on month the number of those employed was up by 219,000 on an uncorrected basis, which was equivalent to an increase of 39,000 ( or 0.1%) on a seasonally adjusted basis. So the great German jobs machine is still working.

The big question which is puzzling many economists however is why this increase in employment does not feed though to private consumption. My own personal feeling is that you need to look at the age profile of the German workforce, and the low value added content of much of the new employment. Some reflection of this can be found in the fact that (on aggregate) labour productivity (price-adjusted gross domestic product per person in employment) in the third quarter of 2008 was down by 0.1% year-on-year in Q3 2008. When measured on a per hour worked basis labour productivity was down by 0.2%.

So jobs are created, but household consumption expenditure hardly moves, and in fact it decreased by 0.3% year on year in Q3, despite the 0.3% increase quarter-on-quarter. So as unemployment has fallen German households have been spending less, especially on food, beverages and tobacco (–1.5%) and on transport and communications (–3.1%). The big factor in the latter decline was the marked decrease in private car purchases and the sharp drop in petrol consumption. As can be seen in the chart below, following the pre- VAT rise spike in Q4 2006, household consumption has remained decidedly lacklustre, despite the economy have had one of its most substantial expansions in over a decade.

If we look at the seasonally adjusted monthly retail sales chart (see below) we will see that these have been dropping steadily (stripping out the December 2006 spike) since mid 2006, and the decline continues.

Price Inflation Falls Dramatically

So to get back to the question I ask in the title to this post, we know that the German economy is going to contract sharply next year - by anything between 2 and 4 percentage points - so given the severity of this shock just what are the dangers that the sudden negative energy shock can push core inflation over into deflation mode?

Well, if we look at German producer prices - which can reasonably be considered a forward looking indicator for future prices, we find that they dropped sharply in November - in fact by the most since records began in 1949. This was of course a reflection pf the fact that the cost of oil declined drastically, but it is also an indicator of growing excess capacity as the global economic slowdown curbs demand. Producer prices fell 1.5 percent month on month, while the year on year rate fell back 5.3 percent. But if we look at the index itself (see chart) we will see that prices peaked in July (when oil prices were at a record), and have been falling steadily since.

And if we take a look at German consumer and producer price inflation together (see chart below), we will see that the energy price shock went in two waves. When the first wave petered out, consumer prices also fell, but they soon steadied, as the force of the expansionary momentum helped prices find a floor. But look what is happening after the second wave, producer prices are in virtual freefall, and these are dragging consumer prices along behind them, and when we think of the scale of contraction which we may well see in 2009, then it seems to me that the danger of opening up a deflationary dynamic behind the shock is a real and credible one.

In fact German consumer price growth slowed to 1.4 percent in Novermber according to the EU harmonized measure, down from 2.5 percent in October, falling significantly below the ECB’s price stability threshold of around two percent, and the lowest level in two years. Again this was the biggest decline since the federal statistics office started calculating German inflation using the HICP methodology in 1996. From a month earlier, prices were down 0.6 percent.

Again if we look at the index itself, we can see that prices have been falling since the summer, but if we dig a bit deeper, and take a look at the core index (that's the one to watch really, without energy, food, alchohol and tobacco, see chart below) then we will find that even on this measure prices have been stationary, and what we now need to watch out for is that the shock from the credit crunch driven GDP contraction addeded to the negative energy shock doesn't simply drive the core index into negative territory. It is impossible to say at the present time whether this will actually happen, but obviously the risk is real, and those over at the ECB would do well to remember this.

Fiscal Stimulus And Rising Deficit Pressure

Reactions to a problem of this magnitute will need to be on two fronts. The ECB obviously need to bring interest rates down rapidly and dramatically, and probably need to be thinking about how they can operate Japan and US style quantitative easing within a Eurosystem framework. On the other hand a fiscal response is essential, and Angela Merkel is reputedly considering a new package of measures in the early new year in addition to the stimulus package (estimated to have a net worth of about 31 billion euros in 2009) already announced.

The German Premier met the leaders of Germany's 16 states last Thursday to discuss additional measures, but no details of the package under discussionhave yet been announced. Angel Merkel did, however, suggest on Friday that the emphasis will be on infrastructure projects such as schools and roads - but since the areas of the Germany economy which are currently suffering most are the exports and capital goods sectors it isn't clear how much value this will really be.

But all of this has a downside, since it is now estimated that Germany will need to sell more debt next year than at any time since the end of World War II to finance the vaious measures being taken. Gross federal bond sales are set to expand by nearly 50 percent - to 323 billion euros ($471 billion) from 220 billion euros this year - according to the emissions calendar of the Federal Finance Agency. The 2009 issuance will be made up of 149 billion euros in bonds with a maturity of one year or more and 174 billion euros in shorter-dated money market securities.

The bond sales calendar is based on a budget that assumes economic growth of 0.2 percent next year, but as we have seen above this forecast is way out of line with what leading economic forecasters anticipate, thus the level of financing will likely be considerably greater at the end of the day, even without any additional stimulus packages.

Thus, following a 2008 budget which was basically balanced following a longer term strategy, Angela Merkel will now need to cope with a federal deficit which is certainly going to expand significantly as tax growth dwindles and spending rises. And bank rescue costs will come on top of the above, pushing the credit requirement up even further. Germany created a 480 billion-euro bank rescue fund in October comprising 400 billion euros in guarantees and as much as 80 billion euros in recapitalization steps, both of which will need to be financed in some form or other through the bond market. It is thought that around 200 billion euros will be approved in guarantees by the end of January and about 20 billion euros in capital measures. It seems however that bonds sold to boost banks’ capital reserves will be reported off budget, and thus not figure in accounts reported to the European Union's Eurostat office.

Germany plans to finance part of its 500 billion euro ($636 billion) bank rescue package by issuing bonds to banks in exchange for new preferred stock, according to Finance Agency head Carl Heinz Daube. ``The banks will not be allowed to sell the injected government bonds,'' Daube said in an interview in Tokyo today. ``So far there's obviously not a huge demand for any rescue measures, but this might change in the coming weeks.'' Germany's rescue plan, approved by lawmakers on Oct. 17, amounts to about 20 percent of the gross domestic product of Europe's biggest economy. Chancellor Angela Merkel's administration pledged 80 billion euros to recapitalize distressed banks, with the rest allocated to cover loan guarantees and losses.

Despite the changed dynamic in public finance, however, the German government is unlikely to experience any real difficulties selling its debt, and the country continues to enjoy a "stable'' outlook from Moody's Investors Service on its Aaa government bond ratings according to a report published earlier this month.

"Germany's public debt payment capacity is strong and Moody's anticipates no problems with regard to affordability or adverse debt dynamics, even with the impact of the economic slowdown likely to be felt on both sides of the government balance sheet,'' said Moody's analyst Alexander Kockerbeck.

It is not clear, however that things are going to remain quite so cut and dry in the future, as the government continues to expand net borrowing on the one hand while slower economic growth even after the recession, on the other, will continue to restrain revenue growth. And as Germany's population ages, health and pension costs are set to mount, and to some extent all this fiscal strain is going to undo a lot of the impact of the "good housekeeping" measures taken in earlier years, making another set of painful reforms more or less inevitable as and when the recovery comes. Angela Merkel is undoubtedly well aware of this harsh reality, and this is surely part of the explanation for why she has tried to keep debt growth under control as possible - much to the chagrin of her EU counterparts in London and Paris, where the demographic dynamics are, of course, much more favourable - even as her budget expands to pay for the emergency fiscal programs.

"A balanced budget remains our target because the demographic changes in Germany will increasingly have an effect from the middle of the coming decade. We must not overburden the younger ones," Merkel said.