Spain’s unemployment, already the highest in the European Union, shot up again in January, rising by the most in at least 13 years, marking the 10th consecutive monthly increase as Spain’s recession continues to deepen.

The number of people registering as unemployed was up by 6.4 percent, or 198,838, from December, and the total reached 3.33 million, according to the latest INEM data release. That was the biggest month on month jump since at least 1996. From January 2008, the number of claimants jumped 47.12 per cent (just marginally above last months year-on-year increase of 46.93 per cent) or by more than a million.

The unemployment rate in Spain - 14.4 per cent in December - is already almost double the European average, compared with 7.4 per cent for the EU overall, according to the most recent monthly data from Eurostat.

Youth unemployment in Spain rose to 29.5 per cent, compared with an EU average of 16.6 per cent. Spain’s jobless rate hit an almost 30-year low of 7.95 per cent in the second quarter of 2007 at the peak of a construction boom that allowed the country to create more than half the new jobs in the euro region between 2002 and 2005. It has been rising ever since. It is hard to make precise projections given that we don't know whether the current rate of contraction in economic activity will remain unchanged, increase, or decrease slightly as the year progresses, but my earlier estimate of around 4.5 million unemployed and a rate of around 20% by December looks pretty realistic at this point. What we dont know is how this will increase in 2010, and I guess projections at this point are premature.

Spanish Manufacturing Continues Its Long Fall

Conditions in the Spanish manufacturing sector continued to deteriorate sharply in January, although the pace of decline did inch back slightly from December's record low, as the Markit Purchasing Managers Index rose to 31.5 from December's 28.5, a reading which had been the lowest level in the near 11-year history of the survey. Still the rate of contraction is very strong (remember 50 is the dividing line between contraction and expansion) and probably represents an annual contraction in manufacturing industry of 15%, and possibly reflects an underlying contraction in GDP of between 1.3% and 1.5% (quarter on quarter) or minus 5% to minus 6% year on year. That is, it is very strong indeed.

"January PMI data suggested that business conditions remained very challenging for firms in the Spanish manufacturing sector," said Markit Economics economist Andrew Harker. "Although many of the indices have risen from the record lows seen at the end of 2008, it must be noted that the contractions in output, new orders and employment continued to be severe in January,"

Export orders again shrank sharply, although at a slightly less severe pace than in December, while Markit noted how some companies reported that exports to the UK were suffering because the euro's strength against sterling was eroding their competitiveness.

Retail Sales Also Fall and Fall

Retail sales (measured in constant prices, ie corrected for price changes) fell 5.6% in 2008 as compared with 2007. Food product sales fell by 2.5%, and non-food products by 7.6%. A breakdown of the latter by type of product shows contraction rates of 4.0% for personal equipment, 12.8% for household equipment and 4.7% for other goods. Retail trade at constant prices decreased 6.1% year on year in December. Food products decreased 3.7%, and non-food products decreased 7.7%.

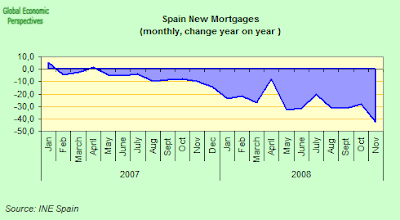

Mortgages Continue To Decrease

The total number of mortgages in Spain fell 42.7% to 80,684 in the 12 months to November, down from October's 28.0% decline, the National Statistics Institute (INE) reported on Wednesday.In monthly terms, the number of mortgages fell 22.1% in November, effectively undoing the 2.7% increase observed between September and October.

The statistics office also noted that total mortgages for houses fell 45.8% to 50,914, down from October's 33.9% annualized fall. Furthermore, the total capital lent for house mortgages fell 51.3% over the same period, outdoing October's 40.7% contraction.

Spain Bank Lending Still Strugging

The root of the problem in Spain is a shortage of liquidity in the banking system as the banks remain unable to finance the 9% of GDP current account deficit by selling asset backed paper in international wholesale markets. What little extra financing there is available, from goverment purchases of bank assets, for example, is largely consumed refinancing debt which comes up for renewal. Thus bank lending to households, while still increasing, continues to show a declining rate year on year, see the chart below. Basically, to maintain the Spanish growth rate where it was required an increase in household and corporate credit of around 20% per annum, and the days when the Spanish banking system could finance such increases, and housholds sustain the debt, are now long gone.

Thus, as we can see in the chart below, the banking system has been struggling to provide finance for household borrowing since the summer of 2007. In July, in fact, new lending seems to have virtually ground to a halt. In November there was some new cash available for lending, but a quick check in the Bank of Spain data reveals that this increase almost entirely went on non housing loans, which normally pay a higher rate, and which the banks are able to themselves finance by paying more to borrow the money.

Thus, as we can see in the chart below, the banking system has been struggling to provide finance for household borrowing since the summer of 2007. In July, in fact, new lending seems to have virtually ground to a halt. In November there was some new cash available for lending, but a quick check in the Bank of Spain data reveals that this increase almost entirely went on non housing loans, which normally pay a higher rate, and which the banks are able to themselves finance by paying more to borrow the money. As we can also see in the next chart, corporate lending has been suffering a similar fate. We can only expect this situation to continue to deteriorate as the government itself now needs to compete with households and corporates for what finance is available to pay for its growing fiscal deficit, part of which is, ironically, going to pay for bank financing. And so round and round we go in circles, with the President of the Spanish government on the one hand urging Spaniards to borrow more to boost consumption, and the Minister of Industry urging them to consume less imports to try and reduce the current account deficit.

As we can also see in the next chart, corporate lending has been suffering a similar fate. We can only expect this situation to continue to deteriorate as the government itself now needs to compete with households and corporates for what finance is available to pay for its growing fiscal deficit, part of which is, ironically, going to pay for bank financing. And so round and round we go in circles, with the President of the Spanish government on the one hand urging Spaniards to borrow more to boost consumption, and the Minister of Industry urging them to consume less imports to try and reduce the current account deficit.

Producer Prices Falling

Spain’s industrial Price Index fell 0.2% in December when compared with December 2007. The activities that most influenced the fall were the manufacture of coke and refined petroleum products (-21.6%), metallurgy (-4.5%) and the chemical industry (–2.6%).

Consumer goods fell o.2% month on month (-0.1% for durable consumer goods and -0.2% for non-durable consumer goods), while intermediate goods fell 1.7% on the month and -8.1% for energy 8.1%. Capital goods prices remained unchanged between November and December. The interannual rate of Industrial prices decreases 0.2%

Consumer Inflation Drops Sharply, So Have We Now Hit Deflation?

Spanish consumer price inflation dropped far faster than expected in January, hitting a record low. The Spanish EU-harmonised annual inflation fell to 0.8 percent year-on-year in January, according to the INE flash estimate, its lowest level in records stretching back a decade, and well below the consensus forecast of 1.2 percent. This was a fall from a 1.5% percent annual rate in December. Inflation in the countries that use the euro dropped to 1.1 percent in January, according to preliminary estimates from the Eurostat statistics office. This number is also quite a drop, and took many analysts by surprise.

Questioned by journalists on the dramatic nature of the fall, Spain's Economy Secretary David Vegara said he felt disinflation would continue in the first half of this year but he did not think it would not turn into outright deflation.

But arguably he is, again, well behind the curve, since if we look at the index chart below, which shows the actual evolution of prices month by month, we can see that the general index has been dropping since the summer, while the core index, without energy, food, alchohol and tobacco, has been stationary for four months now, that is prices have not risen, and is almost certainly about to drop. Thus, in just the same way as I was arguing on this blog that the long cycle had peaked and Spain was recession bound from the sumer of 2007, I am now arguing that we have already effectively entering deflation at this point in time. We have enetered, but when will we leave.....

When Vergara was asked about whether falling inflation would make it more likely that the European Central Bank would cut rates at its meeting next week, he replied: "We are convinced the ECB will take all available data into consideration and act accordingly." But the point is, if we are entering deflation here, and looking at the rate of contraction in the economy, which I am forecasting will be in the region of 5% of GDP this year, we certainly are. And Spanish deflation is likely to be much deeper than anything Japan has experienced, due to the severity of the contraction, which means that what we should be talking about is not simply a half point, or three quarter point, trimming in the ECB repo rate, what we should be asking for is the immediate introduction of Quantitative Easing, but Spains leaders are a long, long way from accepting this reality, and when they do finally accept it it will, unfortunately be too late to find any kind of rapid exit strategy. The issue is expectations. Spanish people still have inflationary expectations, but this will turn, and expectations will change to the anticipation of price decreases, postponement of consumption, and when we do reach this point it will be the devils own work to get them out of that pit.