The global manufacturing recession continued in April, with rates of contraction for output, new orders and employment all showing what are effectively sharp contractions by historical standards. The rates of contraction however moderated almost universally, and this is now the fourth month where this moderation has been evident. Thus, while the contraction is far from over, it is reasonable to say the it has stabilised, and the big issue is at what rate it will hold in the months to come. The initial shock has now been absorbed, but that is a far cry from saying that we already have the worst behind us. The general deterioration in employment conditions raises the concern that as the impact of the government stimulus "shocks" in their turn wane, and as national banking systems come under the impact of the additional loan defaults the growing unemployment and falling property values will cause, then we may see a series of second round effects, not as severe as the initial "hit" last October, but certainly not to something to be taken lightly or "factored out of the picture" at this point.

Sharp Rise In the Headline Global PMI

The JPMorgan Global Manufacturing Purchasing Managers’ Index (PMI) - which is based on surveys covering over 7,500 purchasing executives in 26 countries which between them account for an estimated 83% of global manufacturing output - posted a reading of 41.8 in April, thus coming in well below the critical 50 neutral mark separating expansion from contraction for the 11th successive month. In rising from the 37.3 level shown in March, the PMI managed to post its largest month-on-month improvement in the series history attaining in the process a seven-month high. The sharpest point in the contraction was last December, when the indicator hit the all time series low of 33.7.

The sub-indexes which track output, new orders, new export orders and employment all posted the strongest upward movements in their respective series histories, but still all remained firmly below the neutral 50.0 mark. The rates of contraction for output and new export orders eased to seven-month lows, and total new orders dropped at the weakest pace since August 2008.

The picture was a mixed one, and emerging economies generally fared rather better than developed countries. This was especially the case in China and India, the only two countries covered by the survey to actually to report increases either for output or new orders. Rates of contraction in output eased to a seven-month low in the United States and to the weakest since last October in the euro area. Output and new orders in Spain and Japan continued to fall significantly faster than the global average, but even in these cases the contraction rate improved markedly over earlier rock bottom lows.

Substantial manufacturing job losses continued in April, even if the rate of decline eased to a five-month low. Germany, Switzerland, Australia and South Africa posted series record reductions in employment. China was the only nation to report an increase in staffing levels, and India only reported slight reductions. The rate of job cutting in the U.S. slowed to its weakest since last September, but the reduction in the Eurozone was only slightly better than the series record set in March.

The Global Manufacturing Input Prices Index continued to show significant price decreases, although the reading of 35.5 was a five-month high. Still this again was a historically low reading, and, according to JPMorgan, apart from India and South Africa all of the countries for which data were available reported lower purchasing costs, with rates of decline faster than the global average in the both the U.S. and the Eurozone, giving an indication of just how extensive deflationary pressure is at this point.

Europe

Sweden

Sweden's seasonally adjusted PMI rose to 38.8 in April from 36.7 in March, according to the latest survey from Swedbank and Silf, more or less in line with economists expectations.

The PMI was thus well below the threshold 50 reading for the tenth consecutive month, although April was the fourth consecutive month when the rate of contraction eased. Of particular interest is the fact that the employment index worsened to 28.3 from 31.1, indicating that Swedish manufacturing was shedding jobs at a faster and certainly preoccupying rate. New orders were the single biggest contributor to the rise the overall index, and the sub-index for export orders alone rose to 45.3 points in April from 39.7 March, a feature which was doubtless a by-product of the 15% decline we have seen in the value of the Krona vis a vis the euro since last summer. Sweden's export-dependent economy is facing its worst recession since the 1940s with the global downturn hitting demand for products of key manufacturers like Volvo and SKF. The contraction is easing, but still we are far from having an end in sight, nor will we see one till demand resurfaces in some of the customer economies.

Eurozone

The pace of the slowdown in Eurozone manufacturing activity generally slowed in April, and the PMI rose to a six-month high of 36.8 from 33.9 in March.

Spain

The rate of decline in Spanish manufacturing slowed again in April (for the fourth consecutive month), and April's PMI rose to 34.6 from 32.9 in March. This is now significantly up from December's record low of 28.5, but the contraction remained very strong, and this was still one of the lowest readings globally.

The pace of deterioration eased in output, new orders and employment, though stocks of purchases and finished goods hit series lows. Survey responses suggested the rate of decline in the badly hit jobs market had eased slightly from earlier falls, but the reading still remained well below growth levels, and Spain's economy continues to bleed jobs, adding to levels of employment which the latest labour force survey data suggests has now risen above 4 million (or 17.3% of the economically active population). Staffing levels have declined every month since September 2007, according to survey records.

Italy

Italy's manufacturing business shrank at its slowest rate for six months in April, with the latest Markit/ADACI survey producing a headline PMI reading of 37.2 - significantly above March's record low of 34.6 and beating the consensus forecast of 36.5.

In addition other recent data suggest that the lowest point may have been past with business confidence improving in April (following 10 consecutive monthly falls), and consumer morale hitting its highest level in 16 months. However Markit reported that about 40 percent of companies in the survey reported new order levels continued to fall during the month, even though at the slowest rate of decline in seven months. Output fell at its slowest rate since October, with the sub-index jumping to 35.9 in April from 32.8 in March. Overseas orders, even though they fell less sharply in April, still clocked up their 14th successive month of decline, with Markit noting that demand was particularly weak from Eastern Europe and Russia.

And job losses in Italy's manufacturing sector showed no signs of letting up and were running at the second fastest rate in almost 12 years of data collection following the record low hit by the employment index in March.

However, saying that the "darkest hour" in this contraction may be over is not the same thing as saying that recovery is anywhere in sight. Italy's manufacturing PMI has now not indicated growth since February 2008 and forecasts generally expect the economy to contract by around four percent this year, making for two straight years of continuous contraction for the first time since World War Two. Indeed, the Organisation for Economic Cooperation and Development has even already pencilled in a potential further contraction for 2010, which if realised will mean Italy's economy will have been shrinking for an almost unprecedented 3 years continuously.

Germany

German manufacturing contracted for the ninth month running in April, though the pace of the downturn eased to its slowest since last November. The headline manufacturing PMI in Europe's largest economy registered 35.4, still a very low level, but nonetheless up significantly from March's reading of 32.4.

"April's survey provides hope that the German manufacturing downturn has passed its nadir, as the PMI moved further above January's record low," according to Tim Moore, economist at Markit Economics. "However, output still fell at a rate unprecedented prior to the fourth quarter of 2008, prompting firms to trim employment and inventories to the greatest extent in the survey history," he added.

New orders declined for the tenth successive month but at a much slower pace than in March, with the sub-index rising to 37.0 from 28.9 - a series record month-on-month rise. The improvement in the PMI results fits in with other recent sentiment indicator readings in German, with the Ifo institute's business climate index improving in April to its best level in five months, while the ZEW investor sentiment gauge rose to its highest level in almost two years. However, we are still a far cry from a return to output growth in Germany, with most observers anticipating a GDP contraction of between 5% and 7% for 2009, and given the export dependence we should be looking for an increase in imports in main customer economies before we start thinking about any expansion in German manufacturing output.

France

The pace of decline in French manufacturing activity continued to ease in April, and the Markit/CDAF headline manufacturing PMI rose to 40.1, showing a sharp rebound from March's final reading of 36.5. The April level was the highest since October 2008.

The new orders sub-index jumped to 41.1 from 34.3 in March, while Markit also reported evidence of higher sales to clients in emerging countries, a factor which helped to slow the pace of decline in new export orders.

Other indicators published recently have shown similar positive signals, adding to the sentiment that the French economic contraction may well have stabilised. Household spending on manufactured goods rose by a stronger-than-expected 1.1 percent in March, after a 1.8 percent fall in February, while April's consumer confidence index improved for the second successive month. However the latest employment data shows headline unemployment rising by 63,400 to 2,448,200 in March, and April's PMI survey only added to the bleak news as firms continued to slash jobs over the month. According to Markit , despite easing to its slowest level in 2009, the rate of decline in employment remained close to January's survey record.

Greece

Greece's manufacturing sector also rebounded in April, with the headline manufacturing PMI rising to 40.9 from a record low of 38.2 in March. This was the seventh consecutive month of contraction. The European Commission forecasts that Greece will slide into its first recession since 1993 this year. In its spring forecasts, the Commission forecast the Greek economy would shrink by 0.9 percent this year before recovering positive growth at a rate of 0.1 percent in 2010. The largest looming problem is the budget deficit which is seen as reaching 5.1 percent of GDP in 2009 and 5.7 percent in 2010. As a result general government debt is expected to widen to 103.4 percent of GDP in 2009 and 108 percent in 2010, while unemployment is seen by the Commission at 9.1 percent in 2009 and 9.7 percent in 2010.

Eastern Europe

Poland

Business confidence in Poland's industrial sector was lower than expected in April as new orders kept falling and job shedding continued. The ABN AMRO headline manufacturing PMI dropped marginally to 42.1 in April from 42.2 in March. This meant Poland was one of the few countries which showed a (slight) deterioration in manufacturing conditions in April. New business indicators were mixed in April, with the new orders index falling to 40.9, from 41.4 in March, while new export orders increased to 40.7, from 39.1. The total manufacturing output index fell to 42.0, as industrial companies continued shedding jobs, although at a pace slower than that seen in the first quarter. The April employment index rose to 40.2, from 39.9 in Mrch.

Output prices charged by manufacturers fell in April, while input prices fell for the first time in three months as firms reported lower prices of raw materials.

Czech Republic

The manufacturing decline slowed in the Czech Republic in April, and the headline PMI rose to 38.6 from 34.0 in March. This was the 10th straight month of contraction in Czech manufacturing, with the substantial drop in export orders being the main culprit. April did however see the third consecutive rise in the index reading. Markit said seasonally adjusted new orders remained on an upward trajectory and registered the slowest rate of decrease since last September. Czech manufacturers did, however, continue to make substantial cuts in their workforces in April, and while the employment index rose from March's record low, it still indicated a rapid rate of decline.

Hungary

Activity in Hungary's manufacturing sector continued to contract in April, although the pace of contraction is now down slightly from January's all-time low. The weakness of the rebound however does underline the depth of the recession the country is now in.

The headline manufacturing PMI stood at a seasonally adjusted 40.4 in April, up slightly from the 39.5 registered in March, according to the release from the Hungarian association of logistics. This was the seventh consecutive month of contraction, following the all-time low of 38.5 hit in January. The Hungarian government currently forecasts that GDP will contract by as much as 6% this year as the German economy, Hungary's chief export market, also faces a similar decline in GDP. Hungarian manufacturing output contracted even more in April than in March, to 37.1 from 37.6. The export index showed a further decline to 35.6 from 36.5 in March. The only positive development came from the new orders index which showed a marginal increase to 37.5 from a reading of 35.0 in March.

Russia

The latest VTB Capital headline manufacturing PMI signalled that the sector remained in a strong downturn in April, although as elsewhere the rate of decline slowed again (for the fourth straight month) hitting the almost respectable level of 43.4 (in comparison with what is being seen elsewhere). This was the highest level in six months, although (in terms of historical comparisons) the latest results provide further evidence that the sector is experiencing a longer and more pronounced contraction than that seen during the financial crisis of 1998. At that time the PMI spent seven successive months in negative territory. In comparison the current run already extends to nine months - and we are still far from the end of the process - and in addition the rate of contraction has been much more pronounced.

According to VTB the largest component of the headline PMI – new orders – showed a weaker rate of decline in April. The rate of contraction in new business has now moderated continuously since hitting a survey record in December. However, new export business declined at a faster rate in April compared to March, suggesting that while the Russian administration's stimulus plan may be having some impact, the devaluation of the ruble is yet to make any real impact, possibly due to the hefty rate of continuing internal price inflation and also due to the sorry state of international trade.

Worthy of note is the fact that a number of survey respondents linked lower output levels to payment problems at clients as credit conditions remain challenging.

Average input costs continued to increase in April, although at a weaker rate than that seen in the previous two months. Energy prices and exchange rate fluctuations were reported by firms to have increased costs, but this was partly offset by pressure on suppliers to discount rates as underlying demand remained weak. VTB reported that competitive pressure in the manufacturing sector was evident in April as firms cut output prices for the fifth time in six months. Manufacturers also continued to cut back their workforces in April, and employment in the manufacturing sector has now fallen continuously since May 2008, and the rate of job shedding remained marked despite easing for the third month running.

Asia

Japan

Japanese manufacturing activity contracted at a slower pace for the third consecutive month in April, and the Nomura/JMMA Japan Manufacturing PMI rose to a seasonally adjusted 41.4 from 33.8 in March, the largest gain since data were first compiled in October 2001. However, the index remained below the 50 threshold that separates contraction from expansion for the 14th straight month.

The output component of the PMI index also rose for the third straight month to 39.4 from 25.9 in March. In January the index was at 18.5, the lowest on record. Japan however remains mired in its worst recession since World War Two and after a hefty 3.2 percent GDP drop in the fourth quarter of 2008 is thought to have contracted even more rapidly in the first quarter of this year, despite some early tentative signs of a recovery in exports.

China

China’s manufacturing expanded for the first time in either eight or nine months (depending on which index you chose - see below) as the decline in export orders moderated and investment surged on the back of the government’s 4 trillion yuan ($586 billion) stimulus package.

The CLSA China Purchasing Managers’ Index rose to a seasonally adjusted 50.1 in April from 44.8 in March.

The output index climbed to 51.3 from 44.3, the first expansion in nine months, while the reading for export orders rose to 48.8 from 41.4 in March. The total new-orders index climbed to 50.9 from 43.6 and the employment index rose to 50.9 from 47.1, the first expansions in nine months for both measures.

On the other hand the official (government sponsored) China Federation of Logistics & Purchasing manufacturing index also showed growth, in this case for the second consecutive month, with the headline index rising to 53.5 in April from 52.4 in March.

There are various differences between the two indexes (for a summary of the issues raised see my last month's post here), but the gist of the matter is that the government-backed measure is weighted more than the CLSA index toward large state-owned enterprises, which have benefited more directly from the government stimulus measures.

India

The April reading for the Indian headline manufacturing PMI is the highest in seven months and the index has now steadily risen after hitting a trough of 44.4 in December. Indeed output at Indian factories grew for the first time in five months in April, with the ABN Amro Bank's index rising to 53.3 from 49.5 in March.

The new orders index rose to 54.9 from 49.5 in March. The return to growth was primarily driven by an improvement in domestic demand, according to the accompanying report. "Although the rise in new business came principally from the home market, there was also some, albeit slight, improvement in foreign demand for Indian manufactures," ABN Amro Bank said in the official release.

Indices tracking trends in output and new orders continued to rise, both breaching the neutral threshold of 50 for the first time since last October, it added. It should be noted, however, that growth of both output and new orders was well below their survey averages. Along with the expansion Indian manufacturers noted renewed input price inflationary pressures. A combination of increased prices for some commodities and unfavourable exchange rates led to a moderate rise in input costs during April. This is the first time that input price inflation has been recorded in India's manufacturing sector since October last year. However continuing competitive pressures meant that manufacturers did not pass on their cost pressures on to customers, and factory gate prices were cut for the sixth straight month. However, the latest drop in average prices was the weakest in the current period of falling output prices.

Employment levels across India’s manufacturing economy were little-changed during April with increased production requirements leading to recruitment on the one hand, while cost-cutting pressures produced job losses on the other.

"The April PMI gives a very clear indication that business conditions in the manufacturing sector have improved significantly after a period of sharp contraction and gradual stabilisation. The headline PMI at 53.3 has signaled expansion in activity for the first time since October 2008. Moreover, the April reading is the strongest since October 2008," according to Gaurav Kapur, Senior Economist, India, with ABN Amro.

"Survey data suggests that production was ramped up during April in order to cater to a pick-up demand and to build inventories. The output index printed at 55.7 for April compared to 49.3 in March, as new incoming business expanded during the month. The domestic orientation of the improvement in demand is clearly visible from the new orders index rising well above 50, even though external demand also improved modestly. New orders index printed at 54.9 as against 49.5 in March. This is critical as it suggests that domestic demand conditions are now strong and supportive for growth in the sector," he said.

"While activity levels improved, the manufacturing sector witnessed some margin pressure, as inflation resurfaced on the input side but output prices contracted. For the first time since October 2008, input prices rose over the month of April. However, as demand conditions are improving, manufacturers could gradually be in a position to raise output prices too. It therefore appears that inflationary conditions in the economy, which remain benign currently, could see some upside pressures going forward," Kapur added.

Americas

United States of America

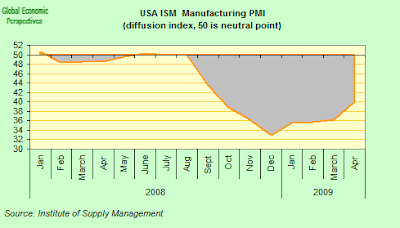

Economic activity in the United States manufacturing sector contracted again in April for the 15th consecutive month, and the overall economy contracted for the seventh consecutive month according to the US Institute for Supply Management's latest Manufacturing ISM Report On Business. According to Norbert J. Ore, chair of the Institute for Supply Management Manufacturing Business Survey Committee, "The decline in the manufacturing sector continues to moderate.....After six consecutive months below the 40-percent mark, the PMI, driven by the New Orders Index at 47.2 percent, shows a significant improvement. While this is a big step forward, there is still a large gap that must be closed before manufacturing begins to grow once again. The Customers' Inventories Index indicates that channels are paring inventories to acceptable levels after reporting inventories as 'too high' for eight consecutive months. The prices manufacturers pay for their goods and services continue to decline; however, copper prices have bottomed and are now starting to rise. This is definitely a good start for the second quarter."

Brazil

The seasonally adjusted Banco Santander manufacturing PMI continued to indicate a sharp contraction in Brazilian manufacturing in April. All five component indexes gave negative readings. The PMI has now registered contraction since the start of the fourth quarter of 2008. However, the reading was up for the third successive month at 44.8, suggesting a further easing in the rate of deterioration.

April’s rise in the PMI reflected less severe drops in both output and new orders. Production levels at Brazilian manufacturers continued to fall, but the rate of contraction eased sharply to its weakest since last September. Declining output was predominantly attributed to unfavorable financial and economic conditions, alongside lower levels of new business. However, incoming work contracted at a noticeably slower rate than in March. Data suggested a milder decline in domestic sales, however foreign demand for Brazilian products fell at a faster pace than in earlier months.